Wall Street sees worst day since April as president retaliates against rare earth export controls

President Donald Trump announced a sweeping 100 percent tariff on Chinese imports Friday, triggering a sharp market selloff and raising questions about an upcoming summit with Chinese President Xi Jinping.

The move came in direct response to Beijing’s decision this week to tighten export restrictions on rare earth minerals, materials critical to artificial intelligence development, semiconductors, and defense manufacturing.

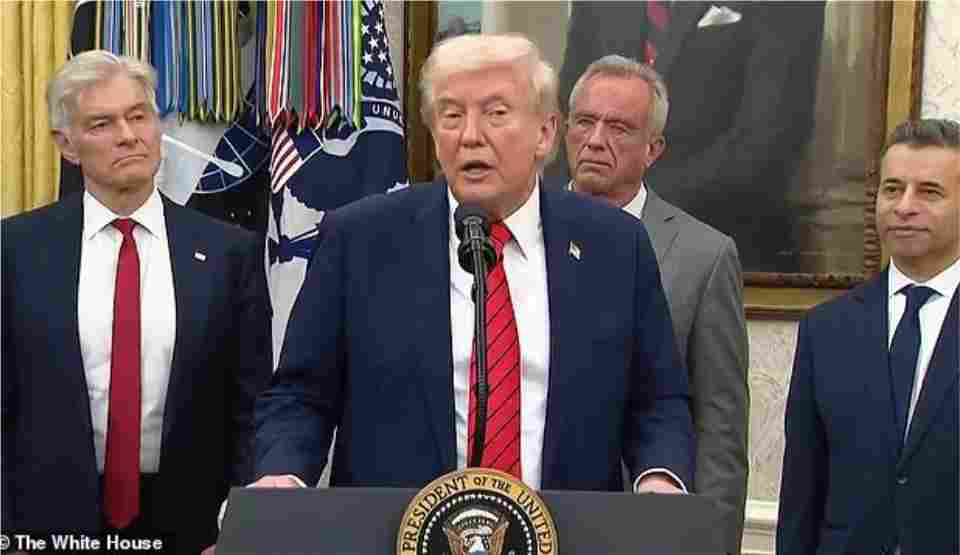

Speaking from the Oval Office, Trump expressed disappointment over China’s action, noting his previously cordial relationship with Xi. He characterized the rare earth restrictions as targeting the global economy rather than the United States specifically, though he called the move “very bad.”

The tariff announcement sent shockwaves through financial markets. The S&P 500 plunged 2.71 percent, marking its steepest single-day decline since the Liberation Day tariffs took effect on April 10. The Dow Jones Industrial Average fell 1.9 percent, while the technology-focused Nasdaq dropped 3.56 percent.

The new 100 percent duty will be layered on top of existing tariffs that already range from 50 percent on steel and aluminum to approximately 7.5 percent on consumer goods. Set to take effect November 1, the combined tariffs will push average duties on Chinese products even higher than the current 57 percent rate.

Consumer Impact Expected to Be Substantial

American households should brace for higher prices across numerous product categories. Electronics, clothing, furniture, kitchenware, and small appliances will all see cost increases, though products won’t necessarily double in price since tariffs apply to import values rather than final retail costs.

The timing couldn’t be worse for holiday shoppers. Toys, smartphones, winter apparel, and home goods purchased this Christmas season will likely carry significantly higher price tags. Technology enthusiasts will be particularly affected, as laptops, tablets, televisions, and gaming consoles depend heavily on Chinese manufacturing. Earlier tariffs in April forced Nintendo to postpone the launch of its Switch 2 console.

Even grocery bills may climb, as many packaged foods and ingredients either come from China or contain Chinese-made components. The automotive sector will also feel the squeeze, with both imported and domestically assembled vehicles potentially costing more due to Chinese electronics, batteries, and rare earth materials in their production.

The Rare Earth Battleground

China controls 70 percent of global rare earth mineral supply and 90 percent of processing capacity, giving Beijing enormous leverage over high-tech supply chains. The country’s new restrictions, beginning in December, require foreign companies to obtain special approval to export products containing even trace amounts of Chinese rare earths or made using Chinese processing technology. Military-related exports are expected to face denials.

Trump accused Xi of trying “to hold the world captive” through this “monopoly position,” calling it a “rather sinister and hostile move.” He suggested the situation may impact their scheduled meeting at the Asia-Pacific Economic Cooperation Summit later this month, though he hasn’t officially cancelled.

This confrontation mirrors a similar dispute resolved just months ago through negotiations led by Treasury Secretary Scott Bessent in the UK and Europe. Both sides had previously relaxed export controls, but Beijing appears to be using the restrictions to force Trump back to the bargaining table.

Building Independence

The United States has already begun investing in domestic rare earth production to reduce dependence on China. MP Materials is opening a magnet manufacturing plant in Texas using American-sourced materials, Noveon has secured supply from Australia’s Lynas, and the Defense Department has committed $400 million to stabilize supply and pricing.

Industry experts view China’s latest move as both an economic and geopolitical strategy, pushing countries and corporations to diversify their supply chains and develop independent sourcing.

Market Winners

While broader markets tumbled, rare earth-related stocks surged on Trump’s announcement. MP Materials climbed 15 percent, USA Rare Earth jumped 19 percent, Energy Fuels gained over 10 percent, and NioCorp Developments rose nearly 14 percent as investors bet on increased demand for non-Chinese rare earth sources.

Trump hinted that additional export controls on American products may follow, mentioning aircraft and airplane parts as potential targets. He noted that China operates many Boeing planes and relies on American aviation components.

With Chinese tariffs on U.S. goods currently around 33 percent, the escalating trade tensions show no signs of resolution, leaving consumers, manufacturers, and investors uncertain about what comes next.