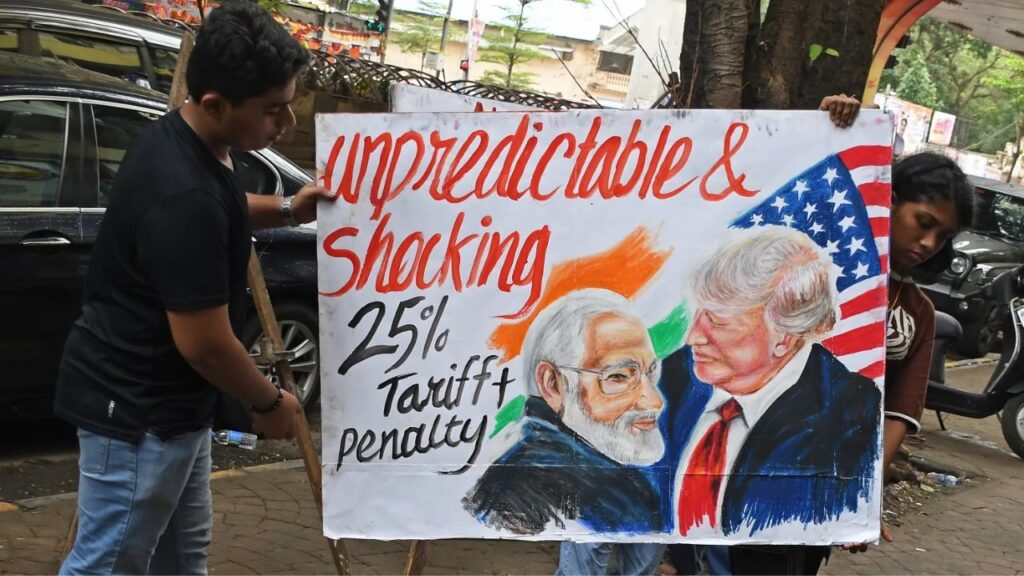

Headline: India Braces for $64 Billion Export Hit to the U.S. Amidst Tariff Hikes and Russian Oil Import Penalties .

India is potentially facing export losses of around $64 billion to the United States. This is primarily due to:

- New U.S. Tariffs: The United States has imposed new tariffs of 25% on certain goods.

- Penalties for Russian Oil Imports: Penalties levied on India for importing Russian oil could increase the effective tariff rates to approximately 35%.

Impacted Sectors:

Several key sectors of the Indian economy are likely to be affected:

- Apparel

- Gems and Jewelry

- Electronics

- Marine Goods

Okay, here’s a more comprehensive overview of the situation:

Headline: India Faces Potential $64 Billion Export Losses to the U.S. Due to Increased Tariffs and Russian Oil Import Penalties

Details:

India is bracing for potential export losses of approximately $64 billion to the United States, stemming from a combination of newly imposed tariffs and potential penalties related to Russian oil imports . The U.S. has implemented new tariffs, set at 25%, on goods imported from India . Furthermore, the Indian government anticipates an additional 10% penalty due to the country’s continued import of Russian oil, potentially raising the effective tariff rate to 35% . President Trump has also indicated he may increase tariffs on India even further [3][4]. These measures are prompting concerns across various sectors and are viewed as a strategic warning and protectionist move .

Impact on Key Sectors:

Several sectors of the Indian economy are expected to be significantly affected [6][7]:

- Apparel and Textiles: This sector is expected to face significant challenges, with potential margin shrinkage for exporters . The U.S. is India’s largest market for garments and home textiles .

- Gems and Jewelry: With a substantial amount of exports to the U.S., this sector faces serious headwinds .

- Electronics: High-volume goods like smartphones and solar modules are likely to be impacted .

- Marine Goods: Marine product exports will likely be affected by the new tariffs .

- Automobiles and Auto Components: A decline in U.S. demand could lead to potential cost reductions and job cuts in this sector .

- Steel and Aluminum: The U.S. remains a crucial market for Indian steel due to its infrastructure spending .

Exemptions:

Some sectors have been excluded from the new tariff measures :

- Pharmaceuticals

- Semiconductors

- Critical Minerals

Economic Ramifications and India’s Response:

- GDP Impact: Economists estimate that these tariffs could reduce India’s GDP by 0.2% to 0.5% if they persist through FY26 . However, one report suggests the direct export loss could be limited to 0.3% to 0.4% of GDP .

- Rupee and Trade Diversification: The Indian rupee has weakened amid expectations of reduced dollar inflows . India may also look to diversify trade .

- Government Stance: The Indian government has stated that the targeting of India is unjustified and unreasonable and that it will take necessary measures to safeguard its national interests and economic security ]. They are also encouraging local production .

Considerations Regarding Russian Oil:

- U.S. Concerns: The U.S. has expressed concerns over India’s import of Russian oil

- India’s Position: India has maintained that its imports are meant to ensure predictable and affordable energy costs for Indian consumers [4][12].

It’s important to note that the situation is dynamic, and the full impact of these tariffs remains to be seen .